Background

Earlier in 2023 we have published two retail trends analysis documents on our blog:

In these articles we have forecasted a stabilization in the retail sector, following a period of high inflation and low demand, eventually leading to an easing in inflation and demand normalizing.

So far in 2023, inflation has decreased significantly globally, with latest rates in the US and Europe stabilizing around 2.97% and shrinking to 6.4% respectively. At the same time, retail demand is growing less than it was expected to. There are multiple reasons behind demand returning slower than the rate at which inflation is easing.

Seasonal factors

Currently in June, July and August most retail customers are vacationing in a travel environment that has normalized back to pre-pandemic standards, taking important purchasing capacity away from retail and into travel and hospitality. The travel industry is seeing record demand even compared with pre-pandemic times. Due to high demand, cost is high for both travel and stay, shrinking consumer budget available for retail purchases further.

Historical factors

Consumer behavior has become far more cautious and conscious of purchasing decisions compared with pre-pandemic times, slowing demand for retail. This is simply because of the high number of dramatic events that have happened in the past year, with the unprecedented scale of the COVID19 global pandemic having created a deep impression on people of all generations who have lived through these perilous times. Recovering from such trauma takes time, its lingering effect on consumer behavior will remain with us for several more years.

Environmental factors

Globally Earth is experiencing one of the hottest summers ever. Environmental scientists warn this will be the norm going forward. Despite record heat, we are experiencing the coolest summer compared to future summers. Heat waves compounded by drought and extensive forest fires blotting out the sun for weeks over several continents, climate change is no longer a debatable theory but an everyday reality with daunting prospects for the immediate future

Ideas and recommendation

While seasonal factors will ease simply by the passing of time, environmental factors will not. The best retailers can do, both for consumer demand and keeping Earth habitable, is to take a meaningful and valuable share of sustainability initiatives and implement them in their trade both in house and in their ecosystems. Such initiatives are not only fashionable but also imperative for a habitable future and are also financially viable.

Consumers are willing to pay more for products that are more sustainable then one season goods, this is especially relevant in fast fashion. One idea for supporting such distinction is some kind of valuation system reflecting an annual cost of goods based on their predicted lifetime – contributing idea credited to Joshua Bellendir of WHSmith North America. This is something retailers can estimate because they know the goods they sell and can work with manufacturers on assuring quality compliance. This way, clothing articles could have a value based on the number of years they are expected to last under normal wear. For example, a shirt that costs $10 but is expected to last 1 year is more expensive than a $20 shirt expected to last 3 years.

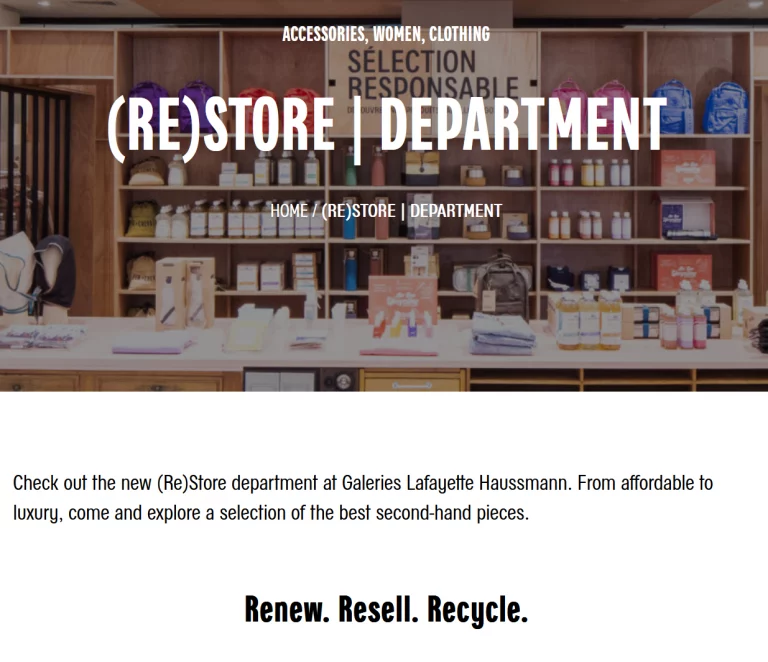

Offering services to consumers for fixing goods, instead of throwing them away, is also sustainable and financially viable, due to the high profit margin on providing such refurbishment and repair services. Our client Galeries Lafayette has a great initiative in sustainable retail, offering consumers the option of buying second-hand refurbished goods, called (RE)STORE.

Driving operations with precision also cuts waste in the business which is not only saving cost and driving profit but is also good for the environment and ultimately the sustainability of our presence on this planet.

Conclusion

Despite stabilizing inflation, consumer demand is recovering slower due to number of factors including seasonal, historical and environmental. Succeeding in such context requires embracing the customer, achieving high precision in operations driving retail business forward and focusing on protecting the environment meaningfully.

Next steps

Contact our experts and explore how we can help you implement meaningful sustainability practices and achieve higher operational precision and profitability at scale!