Why U.S. Elections Don’t Always Impact Retail: Focus on Recessions and Broader Economic Trends

With every U.S. election comes a whirlwind of speculation about how changes in political leadership might affect the economy. For retailers, this often translates into concerns about potential shifts in consumer behavior and the overall business landscape. However, while elections dominate headlines and create a sense of uncertainty, the truth is that retail performance is shaped far more by broader economic conditions—particularly recessions—than by who occupies the White House.

In this article, we’ll explore why U.S. elections don’t have the consistent, direct impact on retail that many believe. More importantly, we’ll explain why focusing on key economic indicators, such as inflation, interest rates, and consumer spending, is crucial for long-term retail success.

The Myth of Elections Driving Retail Sales

It’s easy to assume that political changes following an election will have an immediate effect on retail performance. After all, elections can result in new policies on taxes, trade, and regulations that directly impact business operations. However, while elections can introduce policy changes, these take time to implement, often lagging months or even years before influencing retail in any meaningful way.

More importantly, consumer spending—the heartbeat of retail—is driven by factors that have little to do with politics. Disposable income, employment rates, and interest rates play a far larger role in determining whether shoppers will spend on discretionary items or stick to essentials. For example:

- Disposable income: Consumers are more likely to splurge on non-essential items like clothing or electronics when they have more money to spend, regardless of the political climate.

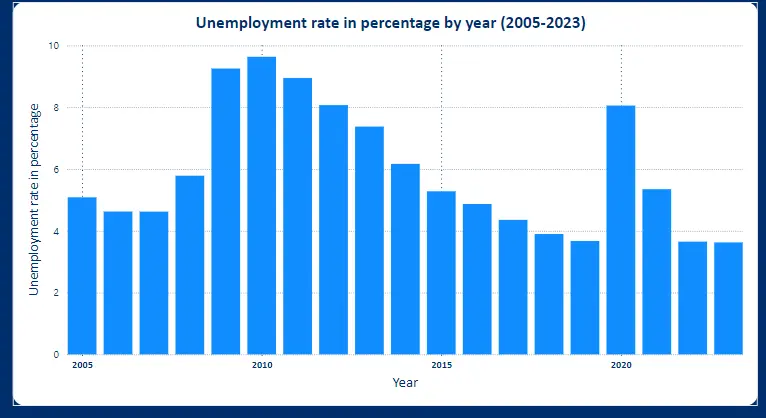

- Employment rates: A strong job market leads to higher spending, while rising unemployment results in cutbacks on retail purchases.

- Inflation and interest rates: These directly influence the cost of goods and borrowing, with immediate effects on consumer budgets and retail pricing strategies.

Therefore, while elections bring uncertainty, they don’t fundamentally change consumer purchasing behavior in the short term. Retailers should be paying more attention to these macroeconomic drivers.

Recessions: The Real Game Changer for Retail

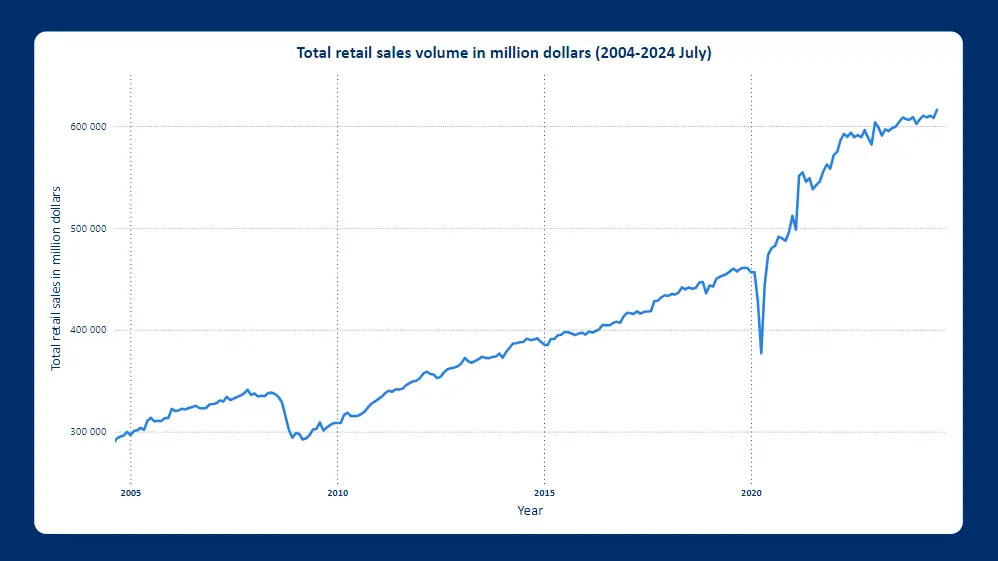

[Total retail sales volume in million dollars (2004-2024), source: www.census.gov]

[Unemployment rate in percentage by year (2004-2023), source: www.macrotrends.net]

When it comes to retail performance, recessions—not elections—pose the most significant challenges. Economic downturns like the 2008 financial crisis or the COVID-19 pandemic have an immediate and lasting impact on consumer behavior. During a recession, consumers tend to cut back on non-essential spending, instead focusing on basic necessities such as food, healthcare, and household goods.

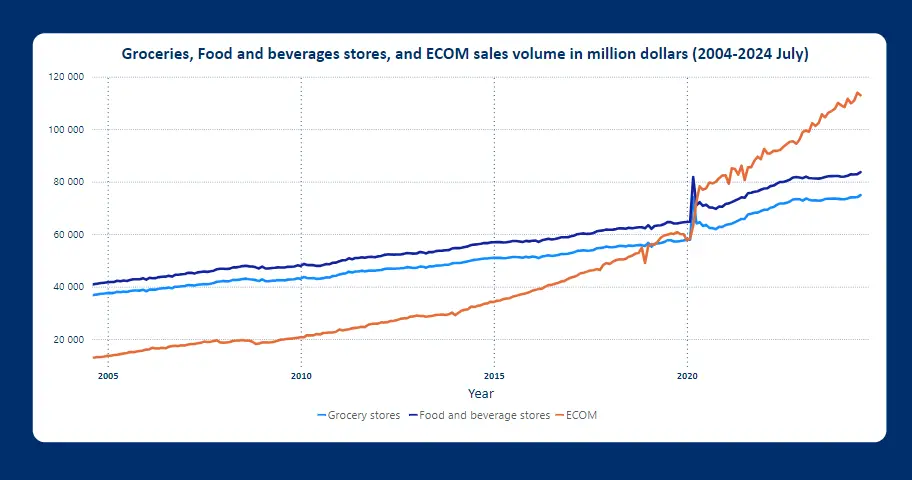

[Groceries, Food and beverages stores, and ECOM sales volume in million dollars (2004-2024), source: www.census.gov]

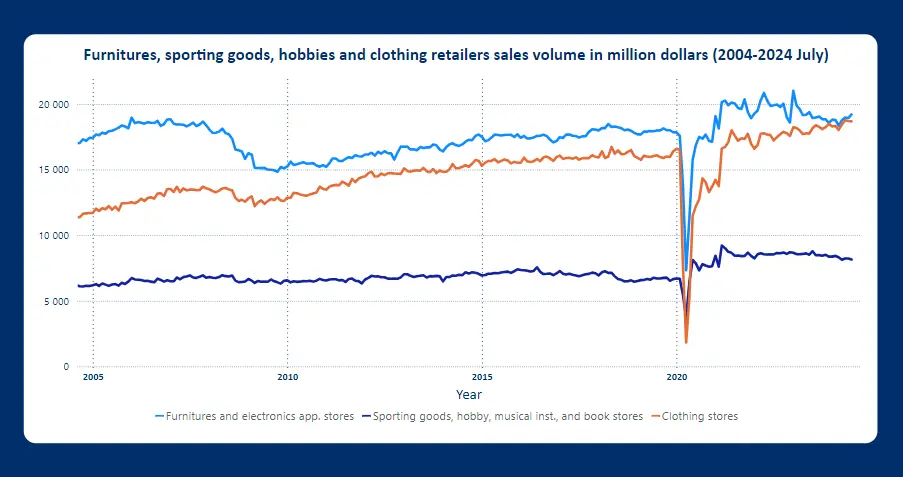

For example, during the 2008 financial crisis, sectors like automobiles, furniture, and luxury goods saw sharp declines as consumers avoided large purchases. Similarly, during the pandemic-driven recession of 2020, non-essential retailers faced revenue drops, while those offering essential products, such as groceries or healthcare supplies, saw a surge in demand.

[Furnitures, sporting goods, hobbies and clothing sales volume in million dollars (2004-2024), source: www.census.gov]

Why Recessions Matter More Than Elections:

- Direct Impact on Spending: Recessions cause immediate reductions in consumer spending as disposable income shrinks and financial anxiety rises.

- Lasting Industry Shifts: Economic downturns often lead to permanent changes in consumer behavior, such as the accelerated shift to e-commerce during the pandemic.

- Sector-Specific Effects: While elections may change policies for specific industries, recessions hit retail sectors like clothing and electronics the hardest, as consumers prioritize essential goods.

Retailers that focus on inventory management, pricing strategies, and consumer insights during a recession will be better positioned to weather the storm.

Why Retail Resilience Is Key, No Matter the Political Climate

While recessions have a direct and immediate impact, retail is an industry known for its resilience. Whether adapting to new policies, environmental regulations, or shifts in trade, retailers have repeatedly demonstrated the ability to evolve. For example how businesses adapted quickly to e-commerce during the pandemic, or how shifts in consumer preferences led to a rise in direct-to-consumer models.

Even during election years, savvy retailers know that the key to success is staying agile. Whether it’s by diversifying sales channels or responding to changes in consumer demand, the retail sector continues to thrive by focusing on what truly drives purchases: economic fundamentals, not political changes.

Key Takeaways for Retailers:

- Stay informed, but don’t overreact: While elections can affect policies on taxes or trade, the direct impact on retail operations is typically minimal and slow to unfold.

- Focus on consumer confidence: Tracking indicators like employment rates and inflation provides better insight into how shoppers will behave in the near future.

- Prepare for economic downturns: Recessions have far-reaching and immediate consequences for retail. Planning for these periods is more important than anticipating election outcomes.

Preparing for the Future: What to Expect for 2024

With the 2024 U.S. election on the horizon, retailers might be wondering how the political landscape will shape their businesses. While no one can predict exactly which policies a new administration might introduce, there are some indirect effects that could come into play, particularly in sectors like energy, automobiles, and healthcare. However, the bigger concern should be whether the broader economy is headed for another recession.

With inflation still a concern, rising interest rates, and potential supply chain disruptions, many economists are warning of a potential downturn. Retailers would do well to focus on preparing for economic uncertainty, including:

- Maintaining lean inventories and cash reserves to weather a slowdown in consumer spending.

- Diversifying sales channels, especially by strengthening online offerings to capture digital-first shoppers.

- Tracking consumer behavior closely to anticipate shifts in spending patterns during periods of economic stress.

Partner with QBCS to Navigate Economic Uncertainty and Thrive in Retail

As you navigate the complexities of the retail industry—whether during an election year or in preparation for a potential recession—having a trusted partner to guide you through economic uncertainty is key. At QBCS, we specialize in helping retailers like you stay ahead of market changes and adapt to evolving consumer behaviors.

Contact us today to learn how we can help you stay agile, maximize your retail performance, and confidently navigate the challenges ahead. Let’s ensure your business continues to grow, regardless of whether it’s an election year or an economic downturn.